[Event Report] Taipower - LCI Workshop Series 6 ''Turbine Blades Recycling Practices & Solutions''

-

The ECCT’s Low Carbon Initiative (LCI) arranged an online workshop together with Taiwan Power Company (Taipower) on the subject of turbine blades recycling practices & solutions. It was the 6th in our series of LCI workshops with Taipower TPRI and the second one of 2022. At the event welcome remarks were made by Dr Chung Nien-Mien, General Manager of Taipower’s Taiwan Power Research Institute (TPRI, 台電綜合研究所所長 鍾年勉博士) and Sean McDermott, ECCT LCI Vice Chair, while presentation were given by Bart Linssen, Managing Director of Enercon Taiwan, Steffen Kruger, Rotor Blade Technical Support of APAC region for Enercon, Allan Korsgaard Poulsen, Head of Advanced Structures and Sustainability at Vestas and Zhao Feng, Head of Strategy and Market Intelligence from the Global Wind Energy Council (GWEC). This workshop was attended by over 110 people online.

The complex mix of materials that go into producing wind turbine blades makes recycling them technically difficult. As the first generation of turbines from Taiwan’s early wind farms are about to reach the end of their useful lives, developers are looking for ways to deal with them while wind equipment makers are doing research into how to make the wind energy industry more sustainable in future.

-

Bart Linssen, Managing Director of ENERCON Taiwan

Bart Linssen, Managing Director of ENERCON Taiwan

-

In his presentation, Bart Linssen spoke about experience of disposing of turbine blades. He began with an overview of his company, including Taiwan where his company has installed 233 turbines (with 699 blades). He noted that several wind farms are reaching the end of their lives, and starting in 2023, 8 turbines weighing 48 tonnes in Penghu will need to be dealt with. The ever-increasing volume of heavy blades will make this challenging. However, he noted that by comparison, the volume of wind turbine blades is much lower than the volume, for example of tyres that need to be dealt with every year.

-

Steffen Kruger, Rotor Blade Technical Support of APAC region of ENERCON

Steffen Kruger, Rotor Blade Technical Support of APAC region of ENERCON

-

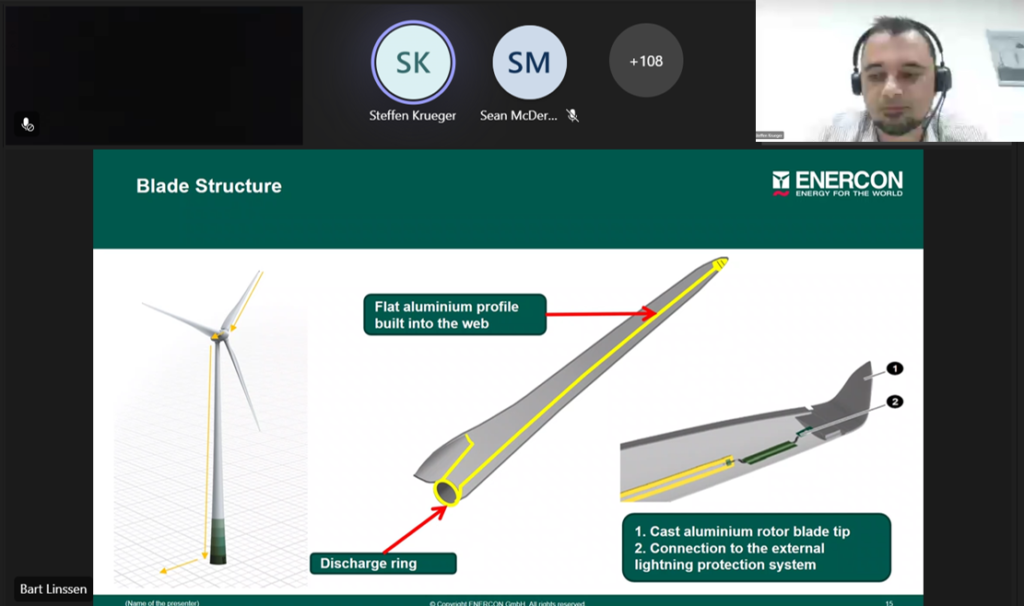

Steffen Kruger said he had experience in repairing rotor blades since 2008. The key components of turbines include glass fibre, wood, foam, aluminium, copper and a small amount of lead. All of the components need to be held together with epoxy, which is almost impossible to separate from the other materials.

Bart Linssen explained that of the total mass of each of his company’s turbine blade, 47% is from glass fibre while resin accounts for another 36%. Enercon’s preferred method is material recovery but given that resin is infused with other materials, this is difficult. Another option is incineration or crushing the blades into small pieces to be used in the production of cement. However, this option is not currently available in Taiwan. Even cutting blades into small pieces and incinerating them is expensive (NT$1.25 million per blade). He concluded that he would like to find a recycling option but so far, no companies have offered one.

-

Allan Korsgaard Poulsen, Head of Advanced Structures and Sustainability of Vestas -

Allan Korsgaard Poulsen, Head of Advanced Structures and Sustainability of Vestas -

In his presentation Allan Korsgaard Poulsen, Head of Advanced Structures and Sustainability at Vestas spoke about his company’s resource recovery policy and economic model of decommissioning wind turbine blades in Europe.

Poulsen is leading a team of engineers on his company’s circularity solution. The company’s overall strategy is to be carbon neutral by 2030 without using carbon offsets and also to reduce zero waste wind turbines by 2040 and blades to be 100% recyclable by 2030. By weight, 80-90% of the company’s turbines are recyclable given the steel structures and other components. However, he reiterated the view of the Enercon speakers that turbine blades are especially difficult to recycle.

He noted that countries in Europe are more advanced in terms of recycling commitments and capacity. Members of Wind Europe have committed to a blade landfill ban by 2025 and provided guidelines on decommissioning onshore wind turbines. French, Dutch and German legislation is moving towards mandatory requirements for recycling blades.

-

-

Vestas has started a blade recycling service. So far 300 blades have been recycled. Using blade materials in cement kilns is viable and economically feasible since the turbine materials can serve as substitutes for other materials used to make cement. Most kilns can be modified to accept turbine materials. Blades can also be used for furniture and other materials, such as playground equipment, but there is not enough volume for these options.

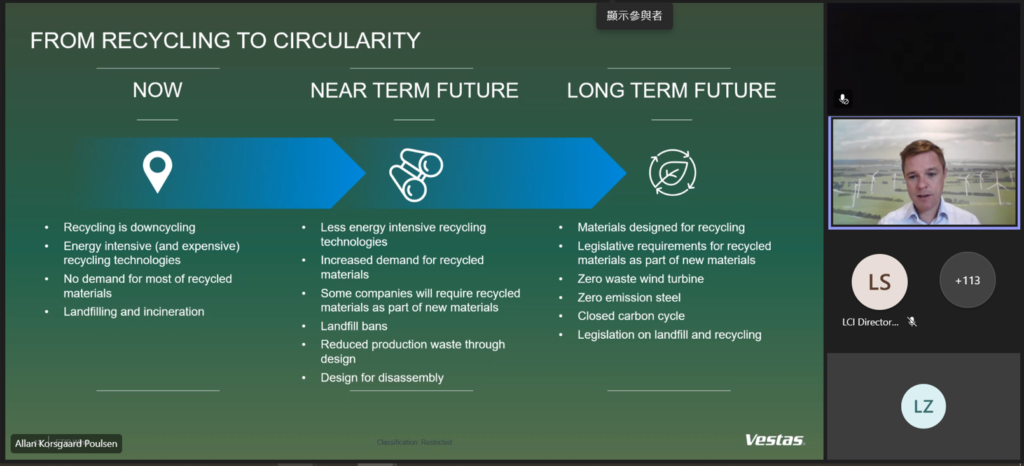

It is possible to recycle glass fibre, but the cost is currently higher than it is for producing glass fibre from virgin materials. He stressed that you need to have good business case and reduce the energy consumption of the recycling process. Currently downcycling not recycling is the most common way to deal with blades and the process is energy intensive, sometimes more so than making new materials and there is currently no market for recycled materials.

In the near term, the trend is to move to less energy intensive recycling. The transport of heavy blades to where they are processed should also be taken into account when measuring the overall environmental impacts and costs. In the long term, materials should be designed for recycling and there will be legislative requirements for recycled materials as part of new materials. He also stressed that recycling technologies need to be able to handle any kind of blades.

-

Zhao Feng, Head of Strategy and Market Intelligence of Global Wind Energy Council (GWEC)

Zhao Feng, Head of Strategy and Market Intelligence of Global Wind Energy Council (GWEC)

-

Zhao Feng, Head of Strategy and Market Intelligence from the Global Wind Energy Council (GWEC) noted that the wind energy repowering will play a big role in reaching global net zero goals. He reported that 93GW of wind energy capacity was added globally in 2021, bringing total installed capacity to 835GW in 2022. However, decommissioning capacity is still low. In 2018, 2019, 2020 and 2022 are 585MW, 379MW 509MW and 1132MW, respectively. As decommissioning increases in the years ahead, more recycling capacity will be needed.

Before 2021 Europe was the largest repowering market (50-75% of market share) followed by Japan. Germany is the largest repowering market in Europe (with 95% market share). IN most years since 2015, there has been more repowering capacity added than decommissioned.

Germany’s renewable energy act (EEG) was a key enabler of wind power installations, but the on-again-off-again repowering incentive created a boom-bust cycle. Following an amendment to the EEG in 2017, all repowering projects have had to participate in onshore wind auctions but the complex permitting rules have slowed down growth.

-

-

He noted that the United States had introduced annual partial repowering since 2017, which allows developers to extend the life span of aged turbines without replacing the full turbines.

Annual installations must quadruple by the end of the decade to meet a net zero pathway. The current global decommission rate is 1GW per year, assuming a 25-year turbine lifetime. The number is expected to increase to 5GW in 2026, 50GW in 2040 and reach 100GW in 2050.